28% Drop In Mazda Exports: US Tariffs Negating USMCA Agreement

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

28% Drop in Mazda Exports: US Tariffs Undermine USMCA Benefits

Mazda's export figures reveal a stark reality: the promised benefits of the USMCA trade agreement are being significantly undermined by ongoing US tariffs. The Japanese automaker has reported a staggering 28% decline in exports, a dramatic fall that highlights the lingering impact of protectionist trade policies and raises concerns about the future of automotive trade between Japan and the United States. This downturn is not just bad news for Mazda; it underscores a broader challenge to the intended free-flow of goods under the USMCA.

The USMCA's Stalled Promise:

The United States-Mexico-Canada Agreement (USMCA), which replaced NAFTA in 2020, aimed to streamline trade and reduce barriers between the three North American nations. While the agreement promised to ease automotive trade restrictions, the reality on the ground paints a different picture. Mazda's significant export drop directly contradicts the USMCA's stated goals of fostering economic growth and increased automotive production in the region.

The Impact of US Tariffs:

The primary culprit behind Mazda's export slump is the continued imposition of US tariffs on imported vehicles and auto parts. These tariffs, implemented under the Trump administration, remain in place despite the USMCA's intention to create a more open market. These tariffs significantly increase the cost of Mazda vehicles in the US market, making them less competitive against domestically produced models and impacting consumer demand. This directly translates into reduced export volumes for Mazda and other Japanese automakers.

Consequences for Mazda and the Broader Automotive Industry:

This 28% decline isn't just a number; it represents substantial losses for Mazda, impacting jobs both in Japan and potentially within its US operations. The ripple effect extends beyond Mazda itself. The reduced export volume affects the broader automotive supply chain, impacting parts suppliers and related industries in Japan. The situation also raises concerns about the long-term viability of investments in North American automotive manufacturing.

Looking Ahead: Navigating Trade Tensions:

The future of automotive trade between Japan and the US remains uncertain. While the USMCA aimed to create a more predictable and stable trade environment, the continued presence of tariffs casts a shadow on its effectiveness. Experts predict that resolving these trade tensions is crucial to unlocking the full potential of the USMCA and ensuring a healthy automotive sector for both countries. Further negotiations and a reassessment of existing tariffs are essential to fostering a more balanced and beneficial trading relationship.

What's Next?

- Increased pressure on the US government: Industry groups and concerned stakeholders will likely increase pressure on US policymakers to reconsider the existing tariffs.

- Potential renegotiations of the USMCA: While unlikely in the short term, the current situation could lead to future discussions on modifying the agreement to address these unforeseen challenges.

- Shifting production strategies: Mazda, and other automakers, might explore alternative strategies such as increased domestic production within the US to mitigate the impact of tariffs.

The significant drop in Mazda exports serves as a potent reminder that trade agreements, while valuable, are only as effective as their implementation. The USMCA's promise of increased trade remains unfulfilled for Mazda, and unless tariff barriers are addressed, the agreement's potential benefits will continue to be stifled. The automotive industry eagerly awaits a resolution to this ongoing trade conflict.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on 28% Drop In Mazda Exports: US Tariffs Negating USMCA Agreement. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Exclusive David Zayas Discusses His Enduring Role As Angel In Dexter

Sep 03, 2025

Exclusive David Zayas Discusses His Enduring Role As Angel In Dexter

Sep 03, 2025 -

Beyond The Criticism A Defense Of Dexters Final Four Seasons

Sep 03, 2025

Beyond The Criticism A Defense Of Dexters Final Four Seasons

Sep 03, 2025 -

Liverpools British Record 130 M Signing Alexander Isak Joins From Newcastle

Sep 03, 2025

Liverpools British Record 130 M Signing Alexander Isak Joins From Newcastle

Sep 03, 2025 -

Jdwl Qymt Tla W Skh Amrwz 11 Shhrywr 1404 Bazar Tla Dr Ashwb

Sep 03, 2025

Jdwl Qymt Tla W Skh Amrwz 11 Shhrywr 1404 Bazar Tla Dr Ashwb

Sep 03, 2025 -

I Phone 17 Lineup Comparing Expected Features Of The Standard Air And Pro Models

Sep 03, 2025

I Phone 17 Lineup Comparing Expected Features Of The Standard Air And Pro Models

Sep 03, 2025

Latest Posts

-

Florida State Faces 50 000 Penalty From Acc For Post Alabama Game Celebration

Sep 03, 2025

Florida State Faces 50 000 Penalty From Acc For Post Alabama Game Celebration

Sep 03, 2025 -

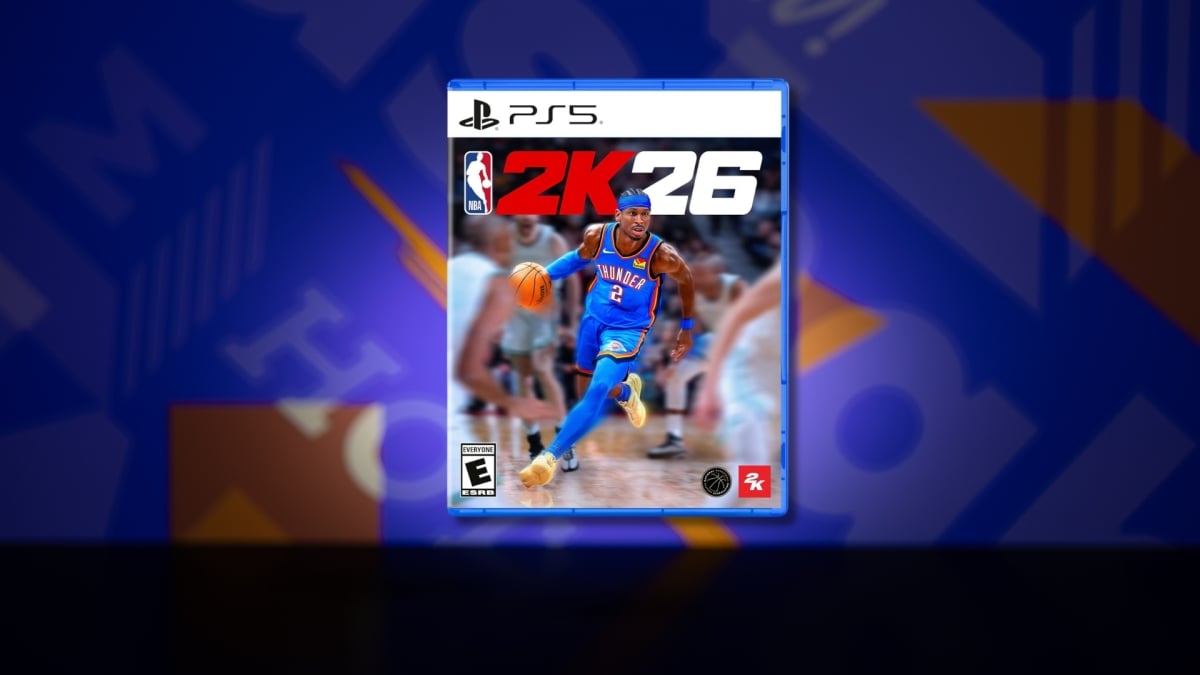

Nba 2 K26 Gameplay First Look A Work In Progress

Sep 03, 2025

Nba 2 K26 Gameplay First Look A Work In Progress

Sep 03, 2025 -

Bone Temple 28 Years After Ralph Fiennes Returns In Zombie Horror Sequel Trailer

Sep 03, 2025

Bone Temple 28 Years After Ralph Fiennes Returns In Zombie Horror Sequel Trailer

Sep 03, 2025 -

Nba 2 K26 Early Access Details Release Date Editions Compared

Sep 03, 2025

Nba 2 K26 Early Access Details Release Date Editions Compared

Sep 03, 2025 -

Lady Gagas Wednesday Season 2 Appearance The Dead Dance Premiere

Sep 03, 2025

Lady Gagas Wednesday Season 2 Appearance The Dead Dance Premiere

Sep 03, 2025