$250 Price Target Looms: What Wall Street Expects From Broadcom's Earnings

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

$250 Price Target Looms: What Wall Street Expects from Broadcom's Earnings

Broadcom (AVGO), a semiconductor giant, is poised to report its Q3 2023 earnings, and Wall Street analysts are buzzing with anticipation. A significant price target of $250 is looming, fueling speculation about the company's performance and future prospects. But what exactly are analysts looking for, and what could drive Broadcom's stock price to such heights? Let's delve into the key expectations and potential catalysts.

Strong Revenue Growth Expected, But…

Analysts generally anticipate robust revenue growth for Broadcom in Q3. The company's diverse product portfolio, encompassing semiconductor solutions for networking, infrastructure, and wireless communications, positions it favorably in a still-strong, albeit slowing, tech market. However, the key question revolves around the strength of that growth. Will it meet or exceed expectations, or will there be signs of a more pronounced slowdown reflecting broader macroeconomic headwinds? Any deviation from projected figures will likely significantly impact the stock price.

Data Center and AI: The Key Growth Drivers

Broadcom's exposure to the booming data center and artificial intelligence (AI) markets is crucial. Demand for high-bandwidth networking solutions and advanced chips supporting AI infrastructure is expected to remain robust. Analysts will be scrutinizing the company's performance in these segments, looking for indications of sustained growth or potential saturation. Strong performance here could be a major factor pushing the stock towards that $250 target.

Navigating Supply Chain Challenges and Macroeconomic Uncertainty

The global semiconductor industry continues to grapple with supply chain complexities. Broadcom's ability to effectively manage these challenges and ensure consistent production will be under intense scrutiny. Furthermore, the looming threat of a global recession is casting a shadow over the outlook. Any commentary from Broadcom regarding its ability to navigate these macroeconomic uncertainties will be closely followed by investors.

Guidance for Q4 and Beyond: A Crucial Indicator

Beyond the Q3 results themselves, investors will be intensely focused on Broadcom's guidance for Q4 2023 and the outlook for 2024. Will the company maintain its optimistic growth trajectory, or will it signal a more cautious approach? This forward-looking guidance will likely be the most significant factor in determining the stock's immediate post-earnings reaction and its potential trajectory towards the $250 price target.

What to Watch for:

- Revenue growth: Meeting or exceeding analysts' consensus estimates is crucial.

- Data center and AI segment performance: Strong growth in these sectors is vital for pushing the stock higher.

- Supply chain management: Successful navigation of supply chain challenges will boost investor confidence.

- Q4 2023 and 2024 guidance: Optimistic projections will be key to reaching the $250 price target.

- Margin performance: Maintaining healthy profit margins amidst rising costs will be closely watched.

Conclusion:

The $250 price target for Broadcom is ambitious, but not impossible. The company's strong position in key growth markets and its overall financial health give it a solid foundation. However, the macroeconomic environment and supply chain dynamics pose significant challenges. The Q3 earnings report will be a pivotal moment, offering valuable insights into Broadcom's ability to overcome these headwinds and maintain its upward momentum. Investors should carefully analyze the results and guidance before making any investment decisions. Stay tuned for updates following the official earnings release!

Related Articles:

- [Link to a relevant article about the semiconductor industry]

- [Link to a relevant article about AI and data center growth]

Disclaimer: This article provides general information and should not be considered financial advice. Always conduct thorough research and consult with a financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on $250 Price Target Looms: What Wall Street Expects From Broadcom's Earnings. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

A Football Icons Legacy Former Nfl And Penn State Stars Jersey Joins Smithsonian Collection

Jun 05, 2025

A Football Icons Legacy Former Nfl And Penn State Stars Jersey Joins Smithsonian Collection

Jun 05, 2025 -

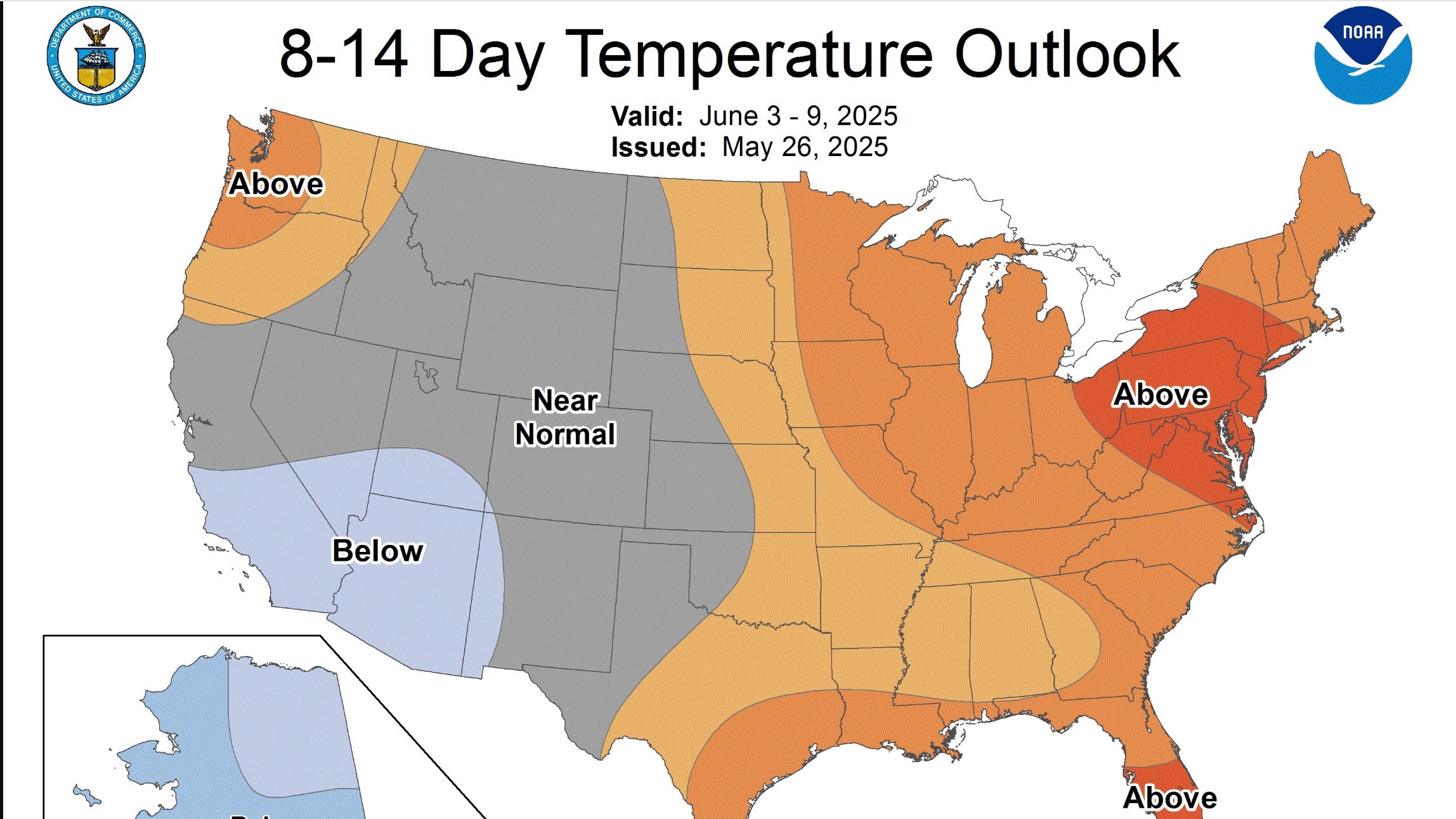

Scorching Temperatures Ahead Willamette Valley Oregon To Bake Under High 80s And 90s

Jun 05, 2025

Scorching Temperatures Ahead Willamette Valley Oregon To Bake Under High 80s And 90s

Jun 05, 2025 -

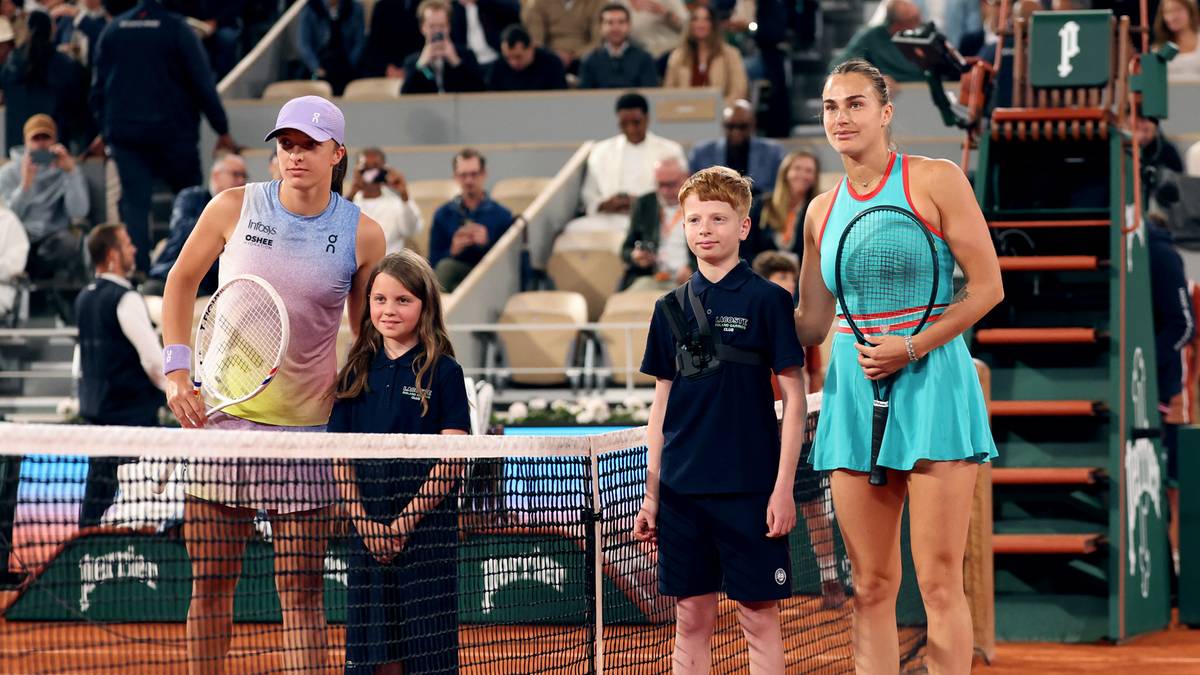

Roland Garros Swiatek Sabalenka Relacja Live Wynik Online I Statystyki

Jun 05, 2025

Roland Garros Swiatek Sabalenka Relacja Live Wynik Online I Statystyki

Jun 05, 2025 -

Halle Berrys Favorite Neck Cream Worth The Hype

Jun 05, 2025

Halle Berrys Favorite Neck Cream Worth The Hype

Jun 05, 2025 -

Mcus Next Black Panther Is Ryan Gosling A Contender Following The Ketema Announcement

Jun 05, 2025

Mcus Next Black Panther Is Ryan Gosling A Contender Following The Ketema Announcement

Jun 05, 2025