$250 Price Target Looms: Wall Street's Anticipation Before Broadcom Earnings

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

$250 Price Target Looms: Wall Street's Anticipation Before Broadcom Earnings

Broadcom's upcoming earnings report has Wall Street buzzing, with analysts predicting a potential surge to $250 per share. The semiconductor giant is poised to unveil its financial performance, and the anticipation is palpable. Investors are eagerly awaiting the results, hoping for confirmation of the company's strong position in the ever-evolving tech landscape. Will Broadcom meet, or even exceed, expectations? Let's dive into the factors driving this excitement and what investors should be watching.

Why the $250 Price Target?

Several factors contribute to the optimistic $250 price target for Broadcom (AVGO). These include:

-

Strong Demand for Semiconductors: The global demand for semiconductors remains robust, driven by the growth of data centers, 5G infrastructure, and artificial intelligence. Broadcom, a major player in these sectors, is well-positioned to capitalize on this continued demand.

-

Strategic Acquisitions: Broadcom's history of strategic acquisitions, such as its recent acquisition of VMware, showcases its proactive approach to expanding its market share and technological capabilities. This expansion is expected to significantly contribute to future revenue streams.

-

Dominance in Key Markets: Broadcom holds a significant market share in crucial areas like wired and wireless communications, networking, and infrastructure software. This dominant position provides a solid foundation for continued growth and profitability.

-

Positive Analyst Sentiment: Many leading financial analysts have expressed positive sentiment towards Broadcom, citing strong fundamentals and a promising outlook. These positive projections are feeding into the rising expectations for the stock price.

What to Watch for in the Earnings Report

While the $250 price target is ambitious, several key indicators will determine whether Broadcom can justify such a valuation. Investors should closely monitor:

-

Revenue Growth: The overall revenue growth will be a crucial metric to assess the company's performance and its ability to meet market demand. Any significant deviation from analyst estimates could impact the stock price significantly.

-

Guidance for Future Quarters: Broadcom's guidance for the next quarter(s) will provide valuable insights into the company's future prospects and potential challenges. This forward-looking information is often a key driver of investor sentiment.

-

Margins and Profitability: Analyzing profit margins and overall profitability will help investors understand Broadcom's operational efficiency and its capacity for sustained growth. Higher margins usually signal a healthier financial position.

-

Impact of Macroeconomic Factors: The global economic climate, including inflation and supply chain disruptions, will likely play a role in Broadcom's performance. Any significant discussion on the impact of these factors will be closely scrutinized.

Risks and Considerations

Despite the bullish outlook, investors need to acknowledge potential risks:

-

Competition: Broadcom operates in a highly competitive market, and any significant shift in competitive dynamics could negatively impact its market share and profitability.

-

Geopolitical Uncertainty: Global geopolitical events can significantly influence the semiconductor industry. Potential trade disputes or sanctions could disrupt supply chains and negatively affect Broadcom's operations.

-

Supply Chain Disruptions: While seemingly under control, persistent supply chain challenges could still affect Broadcom's ability to meet demand and maintain its production targets.

Conclusion: A Cautiously Optimistic Outlook

The $250 price target for Broadcom reflects a cautiously optimistic outlook. While the company’s fundamentals appear strong, several factors could influence the actual outcome. Investors should carefully consider the risks and monitor the key performance indicators in the upcoming earnings report before making any investment decisions. Stay tuned for updates as the report unfolds and the market reacts to the news. This is not financial advice; consult a financial professional before making any investment decisions.

Related Articles:

Keywords: Broadcom, AVGO, earnings report, price target, $250, semiconductor, stock market, Wall Street, investment, tech, technology, AI, artificial intelligence, 5G, data center, revenue, profit, margin, competition, risk, analysis, forecast, prediction.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on $250 Price Target Looms: Wall Street's Anticipation Before Broadcom Earnings. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

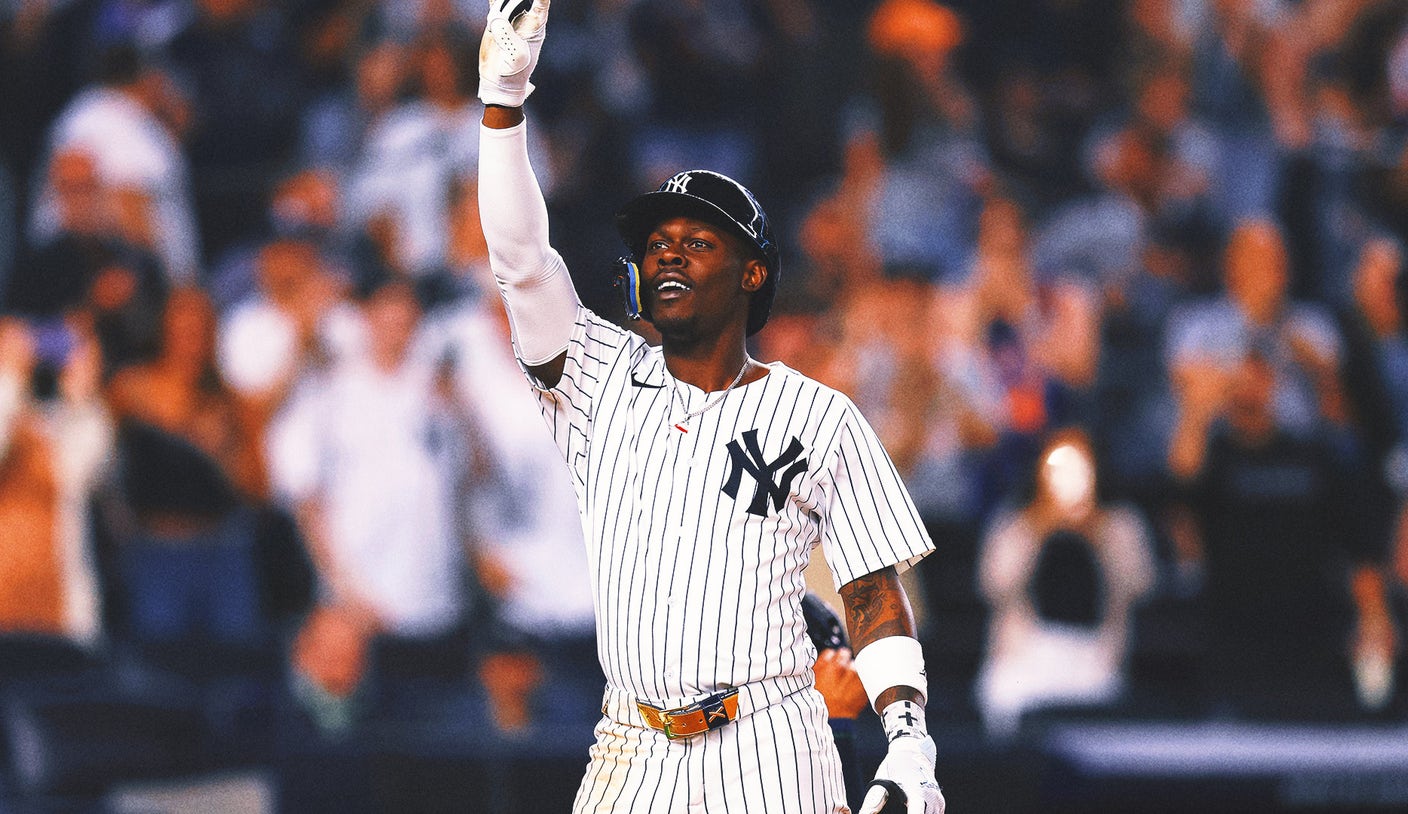

Injury Comeback Chisholm Jr S Home Run Leads Yankees To Win

Jun 05, 2025

Injury Comeback Chisholm Jr S Home Run Leads Yankees To Win

Jun 05, 2025 -

Boston Police Death Case Key Witness Testimony Supports Karen Reads Innocence Claim

Jun 05, 2025

Boston Police Death Case Key Witness Testimony Supports Karen Reads Innocence Claim

Jun 05, 2025 -

Belmont Stakes 2025 Post Time Tv Coverage And Horse Draw Results

Jun 05, 2025

Belmont Stakes 2025 Post Time Tv Coverage And Horse Draw Results

Jun 05, 2025 -

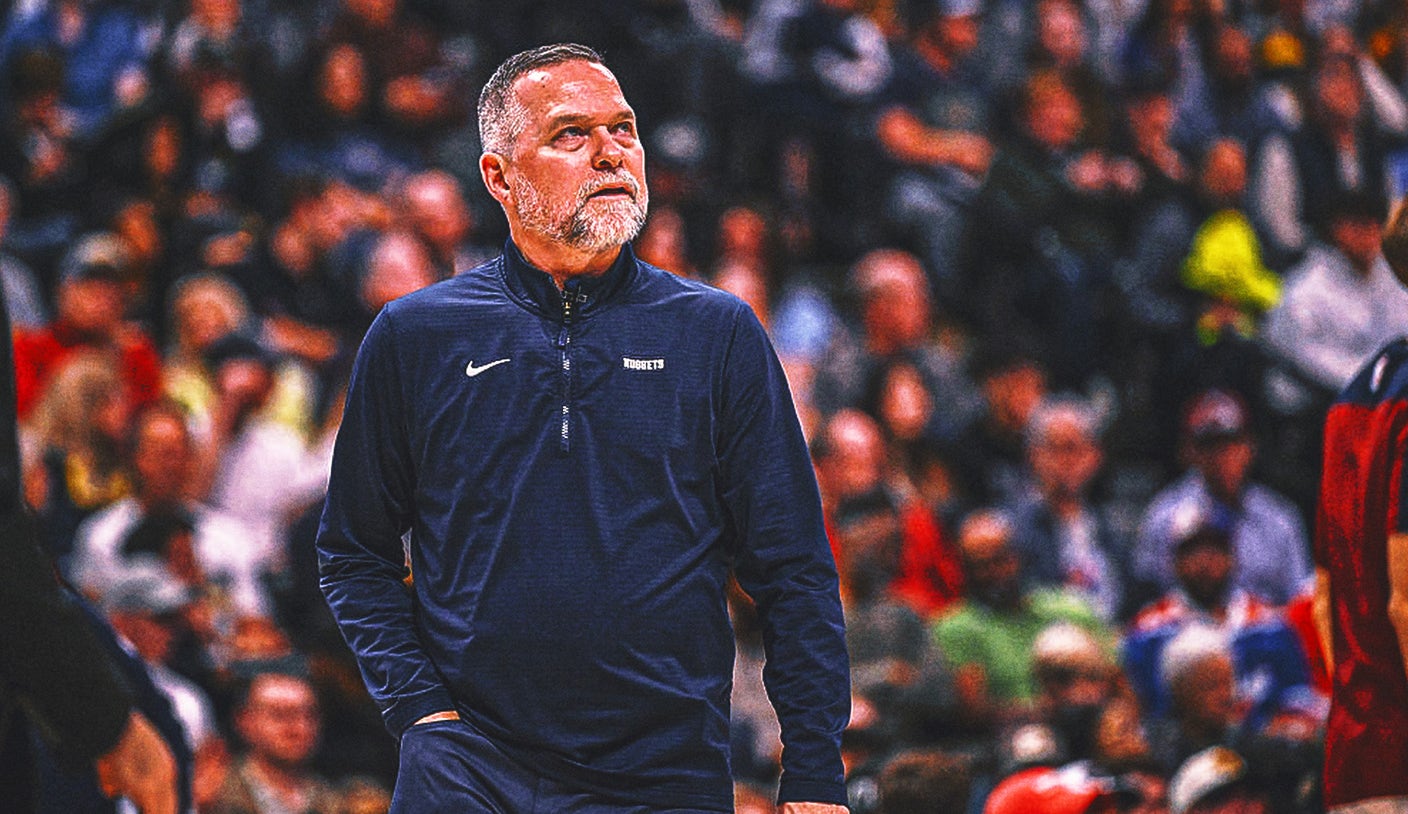

Betting Odds Reveal Frontrunners For Next New York Knicks Head Coach

Jun 05, 2025

Betting Odds Reveal Frontrunners For Next New York Knicks Head Coach

Jun 05, 2025 -

French Open 2024 Sabalenka Beats Zheng Qinwen Reaches Semifinals

Jun 05, 2025

French Open 2024 Sabalenka Beats Zheng Qinwen Reaches Semifinals

Jun 05, 2025