$250 At Stake: Broadcom's Earnings And Wall Street's Expectations

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

$250 Billion at Stake: Broadcom's Earnings and Wall Street's High Expectations

Broadcom (AVGO), a semiconductor giant, is on the cusp of releasing its Q3 2023 earnings report, and Wall Street is buzzing. With a market capitalization hovering around $250 billion, the company's performance holds significant weight for investors and the broader tech sector. Analysts are closely scrutinizing every detail, anticipating guidance that will either solidify Broadcom's position as a tech leader or trigger a market correction. The stakes are undeniably high.

What's at Stake for Broadcom?

Broadcom's success hinges on several key factors. Firstly, the performance of its core businesses – semiconductor solutions and infrastructure software – will be under intense scrutiny. Any slowdown in these sectors could significantly impact the company's overall revenue and profitability. Secondly, the ongoing geopolitical tensions and global economic uncertainty are casting a shadow over the forecast. Supply chain disruptions and weakening consumer demand remain potential headwinds. Finally, competition from other major players in the semiconductor industry will continue to be a challenge.

Wall Street's Predictions and Concerns:

Analysts are divided on Broadcom's Q3 performance. While some predict a strong showing, driven by robust demand for its networking and wireless chips, others are more cautious, citing potential inventory adjustments and a broader slowdown in the tech sector. The consensus estimate for earnings per share (EPS) is currently [insert current EPS consensus estimate from a reliable financial source here], but individual predictions vary considerably. Furthermore, investors will be keenly focused on the company’s guidance for Q4 2023 and beyond. Any hint of a slowdown could trigger a significant market reaction.

Key Areas of Focus for Investors:

- Data Center Demand: The strength of demand for Broadcom's data center chips will be a critical indicator of the company's future prospects. Any softening in this market segment could significantly impact overall performance.

- Wireless Chip Sales: The performance of Broadcom's wireless chip business, particularly in the 5G market, will also be closely watched. Growth in this sector is vital for sustaining the company's momentum.

- Software Revenue Growth: Broadcom's software business is a rapidly expanding segment. Investors will be looking for evidence that this growth is sustainable and profitable.

- Guidance for Q4 2023: The company's outlook for the next quarter will be the most crucial element of the earnings report. Any negative surprises could lead to a sharp decline in the stock price.

Potential Impact on the Broader Market:

Broadcom's performance is not just important for its shareholders; it has broader implications for the tech sector. A strong showing could boost investor confidence, potentially leading to gains across the sector. Conversely, disappointing results could trigger a sell-off, affecting other semiconductor companies and related technology stocks. This underscores the importance of the upcoming earnings report and the intense market anticipation surrounding it.

Where to Find More Information:

For the latest updates and analysis on Broadcom's earnings, be sure to check reputable financial news sources such as [link to a reputable financial news source, e.g., Bloomberg, Reuters, etc.]. You can also access Broadcom's investor relations website for official announcements and financial filings.

Conclusion:

The upcoming Broadcom earnings report is a pivotal moment for the company and the broader tech industry. With $250 billion at stake, the market is holding its breath. The results will significantly impact investor sentiment and potentially reshape the landscape of the semiconductor industry. The next few days will be crucial for determining Broadcom’s future trajectory and the overall health of the tech sector.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on $250 At Stake: Broadcom's Earnings And Wall Street's Expectations. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Dramatic Playoff Sends Cameron Young To The U S Open

Jun 05, 2025

Dramatic Playoff Sends Cameron Young To The U S Open

Jun 05, 2025 -

New York Knicks Fire Head Coach Tom Thibodeau Whats Next

Jun 05, 2025

New York Knicks Fire Head Coach Tom Thibodeau Whats Next

Jun 05, 2025 -

Secure Your Retirement The Importance Of Stress Testing Your Financial Plan

Jun 05, 2025

Secure Your Retirement The Importance Of Stress Testing Your Financial Plan

Jun 05, 2025 -

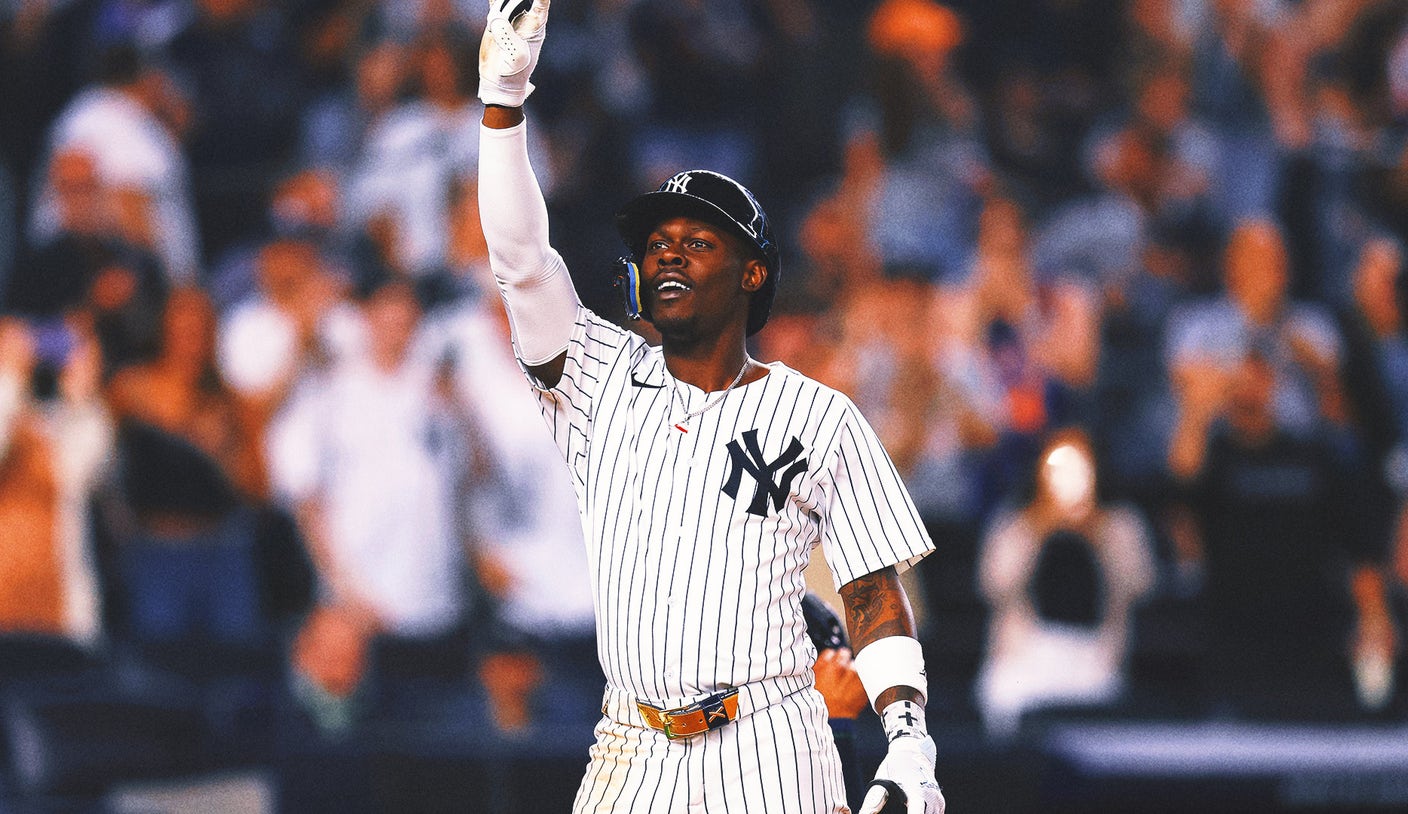

Injury Comeback Chisholm Jr S Home Run Leads Yankees To Victory

Jun 05, 2025

Injury Comeback Chisholm Jr S Home Run Leads Yankees To Victory

Jun 05, 2025 -

Lois Boisson Continues Us Open Charge Defeats Mirra Andreeva

Jun 05, 2025

Lois Boisson Continues Us Open Charge Defeats Mirra Andreeva

Jun 05, 2025