$213 Million In Catastrophe Losses: Allstate (ALL) August 2024 Financial Update

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Allstate (ALL) Reports $213 Million in Catastrophe Losses in August 2024 Financial Update

Allstate Corporation (ALL) announced a significant impact on its financial performance in August 2024, revealing $213 million in catastrophe losses. This substantial figure underscores the increasing financial strain placed on insurance providers by escalating climate-related events and underscores the growing importance of catastrophe risk management in the insurance sector. The news sent ripples through the market, prompting investors to closely examine the company's resilience and future outlook.

This article will delve into the specifics of Allstate's August 2024 financial update, analyzing the impact of these catastrophe losses and exploring the implications for both the company and the broader insurance industry.

Decoding Allstate's August Losses: A Deeper Dive

The $213 million in catastrophe losses reported by Allstate represents a significant portion of the company's overall financial performance for August. While the exact breakdown of the events contributing to these losses wasn't immediately specified in the initial press release, it's highly probable that a combination of factors played a crucial role. These could include:

- Severe weather events: Hurricanes, wildfires, tornadoes, and floods are increasingly frequent and intense, leading to substantial insured losses for companies like Allstate. The increasing frequency and severity of these events are directly linked to climate change, posing a major challenge to the insurance industry's long-term sustainability.

- Geopolitical instability: While less directly impacting Allstate's core business, global events can indirectly influence insurance claims and market volatility.

- Increased claims frequency: Even smaller, less catastrophic events can contribute to higher overall claim volumes, impacting profitability.

Allstate's financial reports will provide more granular detail on the specific types of events and their geographical distribution. Investors and analysts will be scrutinizing these details to better understand the underlying risks and the effectiveness of Allstate's risk mitigation strategies.

The Broader Implications for the Insurance Industry

Allstate's significant catastrophe losses are not an isolated incident. The insurance industry as a whole is facing increasing pressure from climate change and the rising frequency of extreme weather events. This necessitates a fundamental reassessment of:

- Risk modeling and pricing: Insurers need to refine their models to accurately reflect the evolving risk landscape, leading to potentially higher premiums for consumers in high-risk areas.

- Reinsurance strategies: Securing adequate reinsurance coverage is crucial for mitigating the impact of catastrophic losses. Competition for reinsurance capacity is likely to intensify, influencing pricing and availability.

- Investment in climate resilience: Insurance companies are increasingly investing in initiatives that promote climate resilience, from building codes to disaster preparedness programs.

What's Next for Allstate and Investors?

Allstate's response to this financial challenge will be closely watched by investors. The company's ability to manage its risk exposure, adapt its pricing strategies, and leverage technological advancements will be key determinants of its future financial performance. Investors should expect further details and analysis in subsequent financial reports and earnings calls. Further investigation into the specific events and the company's mitigation strategies will provide a clearer picture of the long-term impact. This situation highlights the vital importance of due diligence and risk assessment in the investment landscape.

Keywords: Allstate, ALL, catastrophe losses, insurance, financial update, August 2024, climate change, extreme weather, risk management, reinsurance, investment, stock market, financial performance, insurance industry, claims, weather events

Call to Action: Stay informed about the evolving insurance landscape and the impact of climate change by following reputable financial news sources and company announcements. Consult with a financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on $213 Million In Catastrophe Losses: Allstate (ALL) August 2024 Financial Update. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Project Runway Challenges Designers With Real Clients In New Episode

Sep 20, 2025

Project Runway Challenges Designers With Real Clients In New Episode

Sep 20, 2025 -

Madonna Announces New Album Release Date And Tracklist Speculation

Sep 20, 2025

Madonna Announces New Album Release Date And Tracklist Speculation

Sep 20, 2025 -

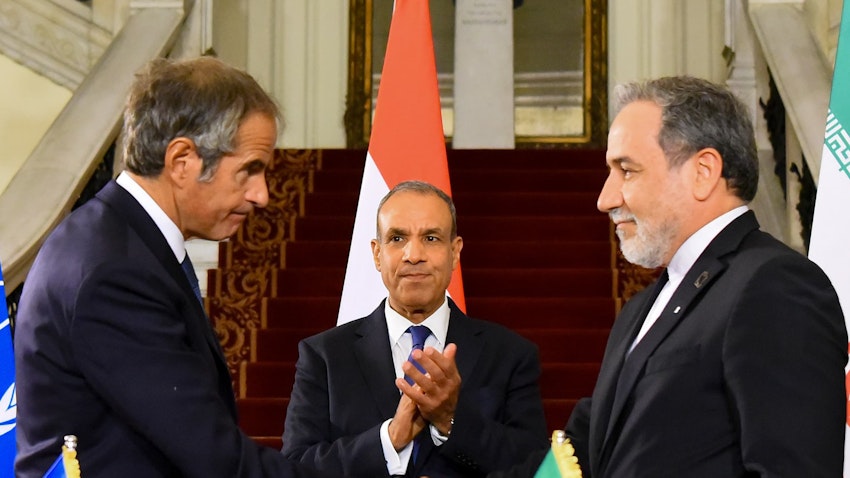

Iranian Hardliners Brace For Potential Un Sanctions From Europe

Sep 20, 2025

Iranian Hardliners Brace For Potential Un Sanctions From Europe

Sep 20, 2025 -

Project Runways New Episode Real People Real Challenges

Sep 20, 2025

Project Runways New Episode Real People Real Challenges

Sep 20, 2025 -

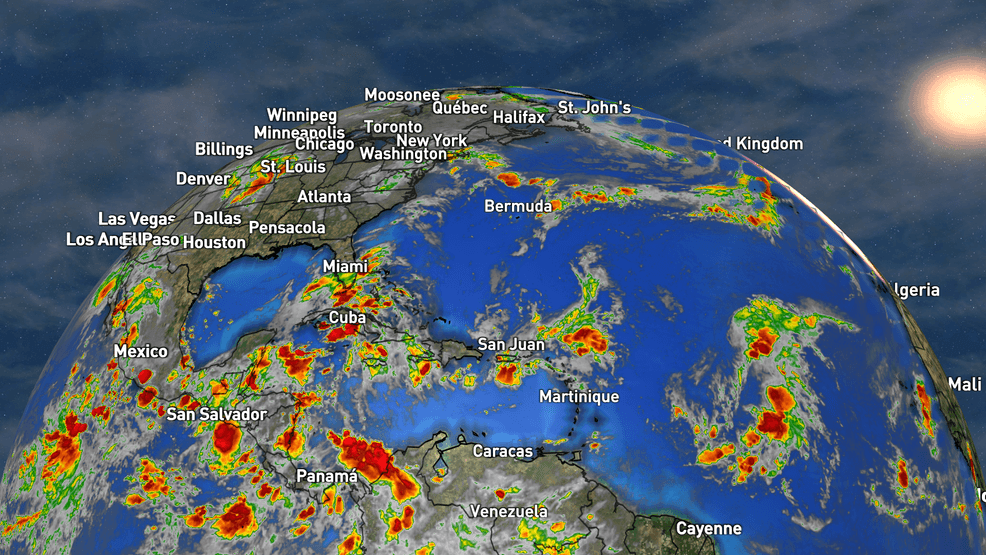

Atlantic Hurricane Season Heats Up Peak Activity Begins

Sep 20, 2025

Atlantic Hurricane Season Heats Up Peak Activity Begins

Sep 20, 2025

Latest Posts

-

Oklahoma State Football Breakdown Insights On The Bye Week Coaching Staff And Player Dynamics

Sep 20, 2025

Oklahoma State Football Breakdown Insights On The Bye Week Coaching Staff And Player Dynamics

Sep 20, 2025 -

No Pressure Ben Johnson On Meeting Tom Bradys Offensive Standards

Sep 20, 2025

No Pressure Ben Johnson On Meeting Tom Bradys Offensive Standards

Sep 20, 2025 -

Mercury Win Game 3 Breanna Stewarts Performance Overshadowed In Wnba Playoffs

Sep 20, 2025

Mercury Win Game 3 Breanna Stewarts Performance Overshadowed In Wnba Playoffs

Sep 20, 2025 -

Watch Oklahoma State Cowboys Vs Tulsa Golden Hurricane Live Stream Tv Channel Start Time

Sep 20, 2025

Watch Oklahoma State Cowboys Vs Tulsa Golden Hurricane Live Stream Tv Channel Start Time

Sep 20, 2025 -

Allstate Reports Significant August Losses 213 Million In Catastrophe Claims

Sep 20, 2025

Allstate Reports Significant August Losses 213 Million In Catastrophe Claims

Sep 20, 2025