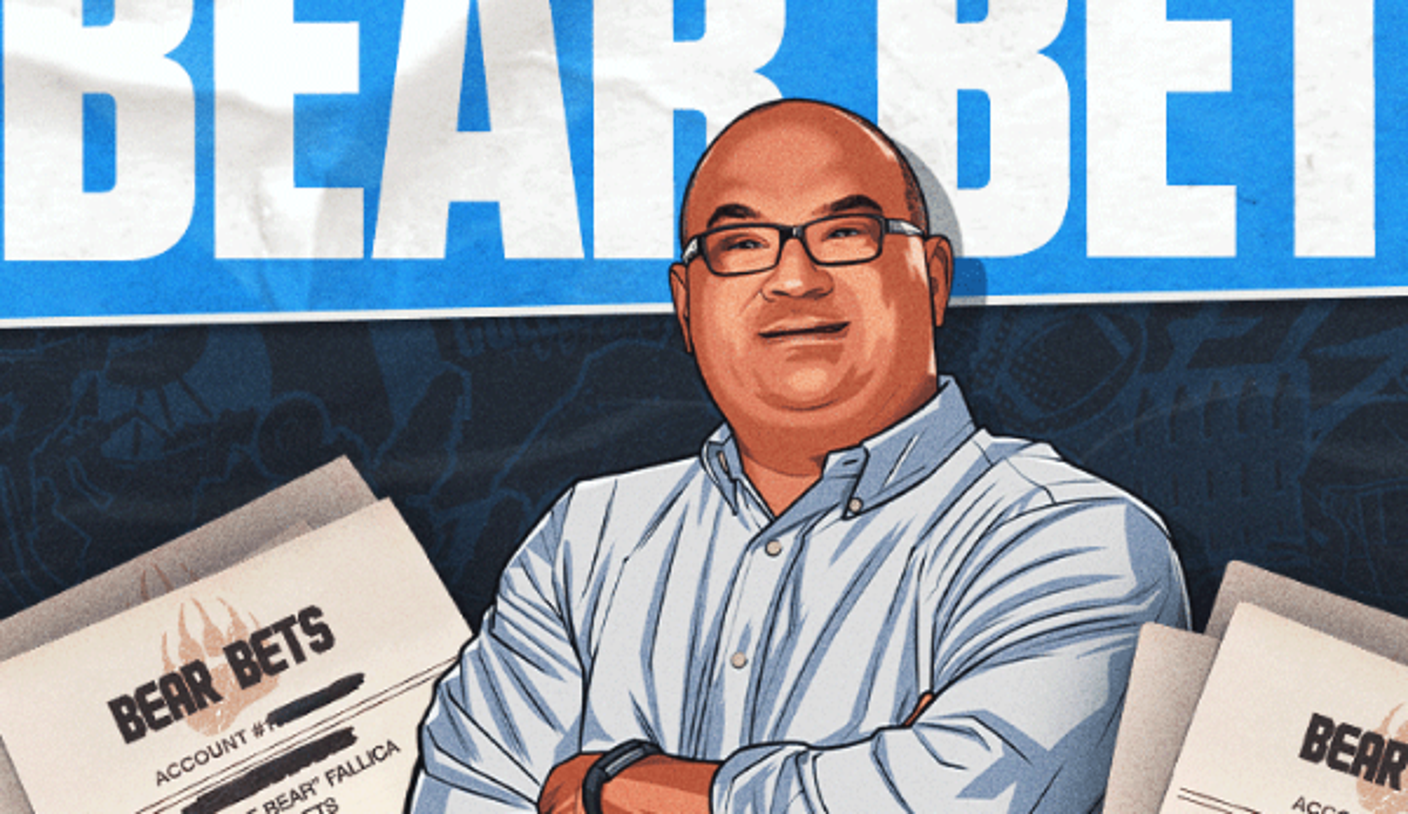

2025 Outlook: Chris "The Bear" Fallica's Best Bets & Predictions

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

2025 Outlook: Chris "The Bear" Fallica's Boldest Bets & Predictions

Financial markets are bracing for another year of uncertainty. But veteran market analyst Chris "The Bear" Fallica is ready. Known for his contrarian views and shrewd predictions, Fallica has shared his insights for 2025, offering a glimpse into potential market movers and game-changing events. This year’s outlook is particularly intriguing, given the lingering effects of inflation and geopolitical instability. Let's dive into Fallica's key predictions and what they mean for investors.

Fallica's Top Three Predictions for 2025:

Fallica's analysis, steeped in decades of experience, points to three significant areas for potential disruption and opportunity in 2025:

-

The Energy Sector Shuffle: Fallica predicts a significant shift in the energy sector, moving beyond the current focus on renewables. While sustainable energy remains crucial, he anticipates a renewed interest in traditional energy sources, driven by supply chain issues and geopolitical considerations. "We're not done with oil and gas just yet," he states. This presents a complex scenario for investors, demanding careful consideration of diversification within the energy portfolio. He suggests looking beyond the usual suspects and exploring smaller, innovative companies in both renewable and traditional energy sectors.

-

The Tech Sector Recalibration: The tech boom of the past decade is showing signs of cooling, and Fallica agrees. He predicts a period of recalibration within the tech sector, with a focus on profitability and sustainable growth over aggressive expansion. "The days of throwing money at a problem and hoping for the best are over," he cautions. Investors should focus on companies demonstrating strong fundamentals and a clear path to profitability. This means scrutinizing balance sheets and evaluating long-term growth strategies, moving away from speculative investments. This aligns with the current trend of investors seeking more stable, value-driven stocks.

-

Geopolitical Uncertainty and its Market Impact: Fallica emphasizes the ongoing geopolitical uncertainty as a significant wildcard in his 2025 forecast. He highlights the potential for unforeseen events to dramatically shift market sentiment. "Investors need to be nimble and adaptable," he advises. This means having a well-diversified portfolio that can weather unexpected storms. He suggests focusing on assets that are less correlated with geopolitical events, such as gold or certain types of real estate. Understanding global political landscapes and their potential impact on different sectors becomes paramount.

Investing Strategies Based on Fallica's Predictions:

Based on these predictions, what should investors do? Fallica suggests a cautious, yet opportunistic approach:

- Diversification is Key: Spread your investments across various asset classes and sectors to mitigate risk.

- Focus on Fundamentals: Invest in companies with strong financial performance and sustainable growth strategies.

- Stay Informed: Keep abreast of geopolitical developments and their potential market impact.

- Consider Alternative Assets: Explore investments beyond traditional stocks and bonds, such as gold or real estate.

- Consult a Financial Advisor: Seek professional advice tailored to your individual financial situation and risk tolerance.

Conclusion:

Chris "The Bear" Fallica’s 2025 outlook is a call for strategic thinking and adaptability. His predictions highlight the need for careful analysis and diversified investment strategies in a complex and ever-changing market. While the future remains uncertain, understanding the potential market shifts can help investors navigate the year ahead and potentially capitalize on emerging opportunities. Remember to always conduct thorough research and consult with a financial advisor before making any investment decisions. What are your thoughts on Fallica's predictions? Share your comments below!

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on 2025 Outlook: Chris "The Bear" Fallica's Best Bets & Predictions. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Dak Prescott Super Bowl Win Or Romos Legacy The Pressure Mounts

Jun 19, 2025

Dak Prescott Super Bowl Win Or Romos Legacy The Pressure Mounts

Jun 19, 2025 -

Report Ryan Donato Nearing Long Term Deal With Chicago Blackhawks

Jun 19, 2025

Report Ryan Donato Nearing Long Term Deal With Chicago Blackhawks

Jun 19, 2025 -

River Phoenix And Martha Plimpton A Goonies Romance Remembered

Jun 19, 2025

River Phoenix And Martha Plimpton A Goonies Romance Remembered

Jun 19, 2025 -

Dak Prescott Under Pressure Super Bowl Success Or Another Disappointment

Jun 19, 2025

Dak Prescott Under Pressure Super Bowl Success Or Another Disappointment

Jun 19, 2025 -

Coastal Carolinas Jacob Morrison Makes College World Series History

Jun 19, 2025

Coastal Carolinas Jacob Morrison Makes College World Series History

Jun 19, 2025