2 S&P 500 Stocks To Consider Buying During Market Correction

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

2 S&P 500 Stocks to Consider Buying During a Market Correction

Market corrections. Those two words send shivers down the spines of even the most seasoned investors. But experienced investors also know that corrections often present opportunities to buy strong stocks at discounted prices. Instead of panicking during a market downturn, savvy investors see it as a chance to strategically bolster their portfolios. This article highlights two S&P 500 stocks that could be attractive buys during a market correction, focusing on their resilience and long-term growth potential. Remember, this is not financial advice; always conduct your own thorough research before making any investment decisions.

Understanding Market Corrections

Before diving into specific stocks, let's briefly define a market correction. A correction typically signifies a market decline of 10% or more from a recent peak. These dips can be unsettling, but historically, they've been followed by periods of growth. Understanding the reasons behind the correction – be it inflation concerns, rising interest rates, or geopolitical instability – is crucial for informed decision-making. [Link to a reputable source explaining market corrections]

Stock #1: Microsoft (MSFT)

Microsoft consistently ranks among the giants of the tech sector and the S&P 500. Its diverse revenue streams, spanning cloud computing (Azure), productivity software (Microsoft 365), gaming (Xbox), and more, offer a degree of resilience against market fluctuations.

- Resilience Factors: Microsoft's subscription-based revenue models provide predictable income streams, mitigating the impact of economic downturns. The continued growth of cloud computing further strengthens its position.

- Long-Term Growth Potential: The ongoing digital transformation across industries ensures consistent demand for Microsoft's products and services. Investments in AI and other emerging technologies position the company for future growth.

- Current Valuation: While always subject to change, assessing Microsoft's current valuation against its historical performance and future projections is key. [Link to a reputable financial news source providing MSFT analysis]

Stock #2: Procter & Gamble (PG)

Procter & Gamble, a consumer staples giant, is known for its portfolio of household name brands. These essential goods, ranging from detergents to personal care products, generally see consistent demand even during economic slowdowns.

- Defensive Characteristics: Consumer staples companies like PG are often considered "defensive stocks," meaning their performance tends to be less volatile than that of growth stocks during market downturns.

- Brand Strength: The power of established brands provides a competitive advantage, allowing PG to maintain pricing power even in challenging economic environments.

- Dividend History: PG boasts a long history of dividend payments, making it attractive to income-focused investors. This consistent dividend payout can provide a cushion during market volatility. [Link to Procter & Gamble's investor relations page]

Investing During a Correction: A Cautious Approach

While these two S&P 500 stocks present potentially compelling opportunities during a market correction, it's crucial to remember that investing always involves risk. A diversified portfolio, aligned with your individual risk tolerance and financial goals, is paramount. Consider consulting with a qualified financial advisor before making any investment decisions.

Call to Action: Stay informed about market trends and the performance of your chosen investments. Regularly review your portfolio and adjust your strategy as needed.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. The information provided is not a recommendation to buy or sell any specific security. Investing involves risk, including the potential loss of principal.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on 2 S&P 500 Stocks To Consider Buying During Market Correction. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

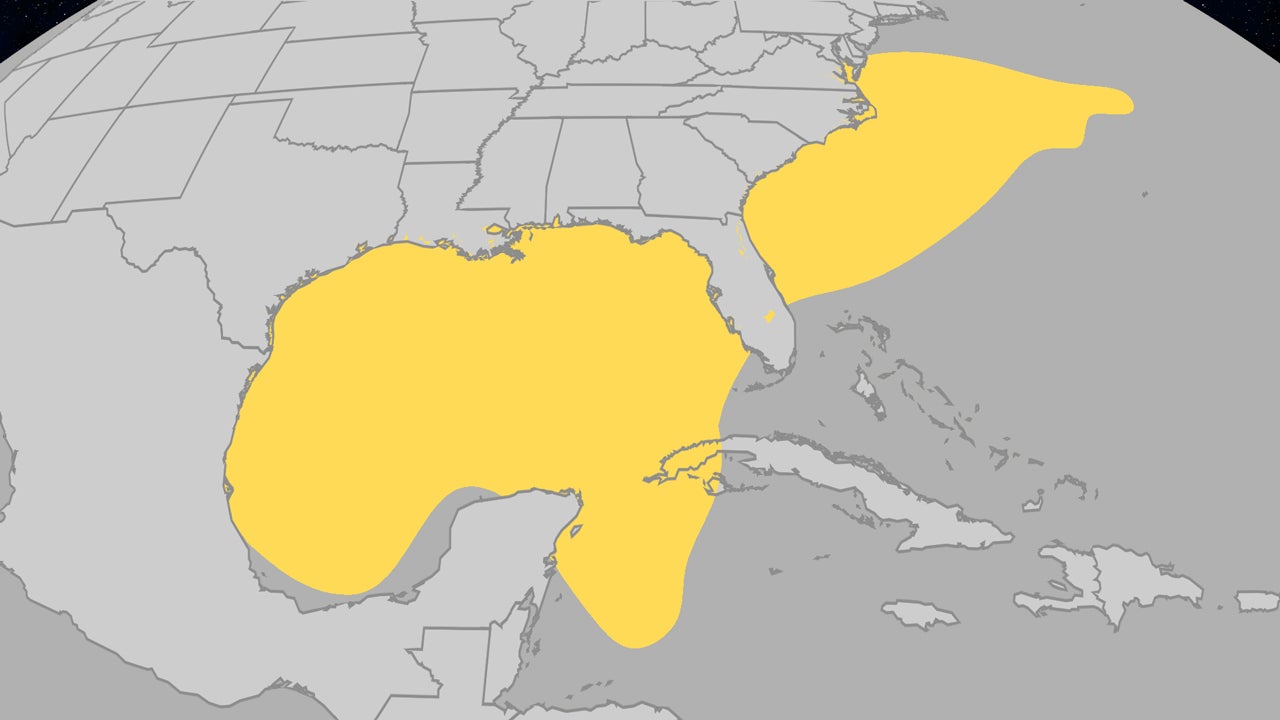

Where Do Atlantic Hurricanes Form In June Understanding The Seasons Start

May 27, 2025

Where Do Atlantic Hurricanes Form In June Understanding The Seasons Start

May 27, 2025 -

Job Quitting Oregonians Cross Pacific Catamaran Adventure

May 27, 2025

Job Quitting Oregonians Cross Pacific Catamaran Adventure

May 27, 2025 -

Majray Njat Psr 14 Salh Az Myan Dywarhay Frwrykhth

May 27, 2025

Majray Njat Psr 14 Salh Az Myan Dywarhay Frwrykhth

May 27, 2025 -

Down 20 Knicks Shock Pacers With Stunning Game 3 Victory

May 27, 2025

Down 20 Knicks Shock Pacers With Stunning Game 3 Victory

May 27, 2025 -

Pentagons Project Maven A Deeper Dive Into Palantirs Ai Role

May 27, 2025

Pentagons Project Maven A Deeper Dive Into Palantirs Ai Role

May 27, 2025