2 S&P 500 Stocks To Buy On The Current Dip: A Value Investor's Perspective

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

2 S&P 500 Stocks to Buy on the Current Dip: A Value Investor's Perspective

The recent market volatility has left many investors wondering where to park their capital. While uncertainty remains, savvy value investors see opportunities in the dip. For those seeking strong, fundamentally sound companies trading below their intrinsic value, two S&P 500 stalwarts stand out as compelling buys. This article will explore why these stocks present attractive entry points for long-term investors.

Navigating Market Uncertainty: The Value Investor's Approach

Market dips, while unsettling, often create buying opportunities for value investors. This investment strategy focuses on identifying undervalued companies – those whose stock prices are below their true worth, considering their assets, earnings, and future growth potential. Instead of chasing short-term gains driven by market sentiment, value investors look for companies with solid fundamentals, strong balance sheets, and a history of consistent performance. This approach requires patience and a long-term perspective, but it can yield significant returns over time. [Link to an article about value investing strategies]

Stock Pick #1: [Company Name A] (Ticker: [Ticker Symbol A])

[Company Name A] is a [brief description of the company and its industry, e.g., leading consumer staples company] with a long history of consistent dividend payments and strong revenue growth. Recent market headwinds have pushed its stock price down, creating an attractive entry point for value investors.

- Why it's undervalued: [Explain the reasons why the stock is considered undervalued, e.g., temporary economic slowdown impacting short-term earnings, but long-term prospects remain strong. Include specific financial metrics like P/E ratio, dividend yield etc., comparing them to historical averages and competitors.]

- Strong Fundamentals: [Highlight key strengths, e.g., robust balance sheet, diversified revenue streams, strong brand recognition.]

- Long-Term Growth Potential: [Discuss future growth drivers, e.g., expansion into new markets, product innovation, technological advancements.]

Stock Pick #2: [Company Name B] (Ticker: [Ticker Symbol B])

[Company Name B] operates in the [industry] sector and is known for its [key strengths, e.g., innovative technology, strong market share]. Despite recent market pressure, its core business remains resilient.

- Undervaluation Thesis: [Explain the undervaluation, perhaps due to temporary sector-specific challenges or concerns that are likely to be resolved. Use specific financial metrics to support this claim.]

- Competitive Advantages: [Detail what sets this company apart from its competitors, e.g., patents, strong management team, first-mover advantage.]

- Resilient Business Model: [Explain the reasons for its resilience and ability to weather economic storms.]

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Conduct thorough due diligence and consult with a financial advisor before making any investment decisions.

Conclusion: Capitalizing on Market Corrections

Market corrections present unique opportunities for long-term investors. By focusing on fundamentally sound companies trading below their intrinsic value, investors can navigate periods of uncertainty and potentially generate significant returns. [Company Name A] and [Company Name B], with their strong fundamentals and compelling valuations, represent compelling additions to a diversified portfolio. Remember to conduct your own research and consider your individual risk tolerance before making any investment choices. Are you ready to take advantage of this dip? Let us know your thoughts in the comments below!

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on 2 S&P 500 Stocks To Buy On The Current Dip: A Value Investor's Perspective. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Trumps Legacy On Immigration The Revised Rules For Cubans Entering The United States

May 28, 2025

Trumps Legacy On Immigration The Revised Rules For Cubans Entering The United States

May 28, 2025 -

Significant Changes To Cuban Immigration Understanding The Trump Era Regulations

May 28, 2025

Significant Changes To Cuban Immigration Understanding The Trump Era Regulations

May 28, 2025 -

Top Backup Qbs Who Could Spearhead An Unexpected 2024 Nfl Playoff Bid

May 28, 2025

Top Backup Qbs Who Could Spearhead An Unexpected 2024 Nfl Playoff Bid

May 28, 2025 -

Il Bayer Leverkusen Sceglie Ten Hag Inizio Di Una Nuova Era

May 28, 2025

Il Bayer Leverkusen Sceglie Ten Hag Inizio Di Una Nuova Era

May 28, 2025 -

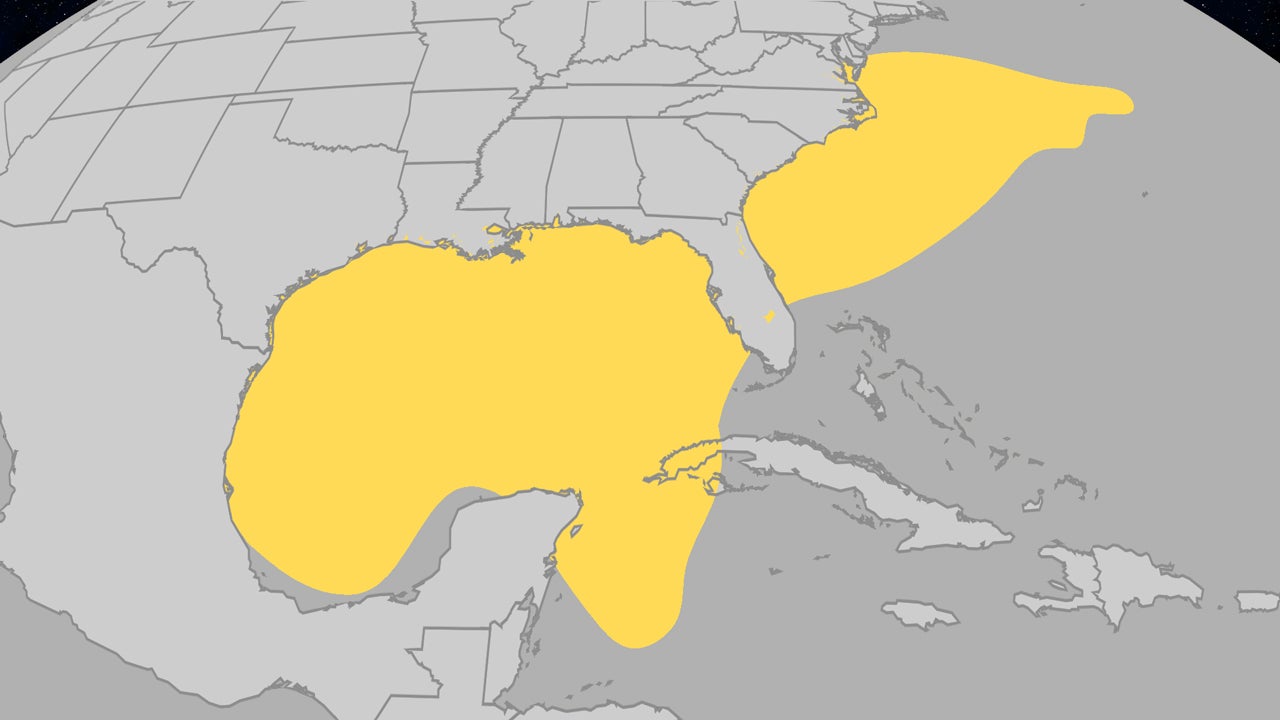

Early Hurricane Season Activity Understanding June Atlantic Storms

May 28, 2025

Early Hurricane Season Activity Understanding June Atlantic Storms

May 28, 2025