$2.387 Billion In Cat Losses: Allstate's Year-to-Date Aggregate

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

$2.387 Billion in Cat Losses: Allstate's Year-to-Date Aggregate Shakes Investor Confidence

Allstate, a leading name in the insurance industry, recently reported a staggering $2.387 billion in catastrophe losses for the year-to-date period. This substantial figure has sent ripples through the financial markets, raising concerns about the increasing impact of climate change and its effect on the insurance sector. The announcement significantly impacted Allstate's stock price and highlights the growing challenges faced by insurers in managing catastrophic risk.

This unprecedented level of losses underscores the escalating costs associated with extreme weather events, prompting analysts to re-evaluate the long-term viability of current insurance models. The sheer magnitude of the figure—$2.387 billion—is a stark reminder of the financial burden borne by insurance companies in the face of increasingly frequent and intense natural disasters.

What Contributed to Allstate's Massive Losses?

Allstate's substantial year-to-date catastrophe losses are attributable to a confluence of factors, including:

-

Increased Frequency and Severity of Natural Disasters: The rising frequency and intensity of hurricanes, wildfires, and severe thunderstorms have significantly increased the payout claims Allstate has had to process. This trend is widely acknowledged by climate scientists and is expected to continue. [Link to scientific report on increasing frequency of natural disasters]

-

Inflationary Pressures: The rising cost of repairs and rebuilding, fueled by inflation, further exacerbates the financial impact of these catastrophic events. This means that the cost of settling claims is substantially higher than in previous years.

-

Geographic Concentration of Risk: Allstate’s significant exposure in geographically vulnerable areas, prone to hurricanes and wildfires, contributes to the substantial losses. Strategic risk management and diversification strategies are being closely scrutinized in light of this.

Impact on Allstate and the Broader Insurance Market

The announcement of Allstate's $2.387 billion in catastrophe losses has had a noticeable impact on both the company and the broader insurance market:

-

Stock Price Volatility: Allstate's stock price experienced significant volatility following the announcement, reflecting investor concerns about the company's future profitability and its ability to manage future catastrophic events.

-

Increased Insurance Premiums: The increased frequency and severity of natural disasters are likely to lead to higher insurance premiums for consumers across the board. This will impact affordability and potentially reduce insurance coverage rates.

-

Re-evaluation of Risk Models: The industry is likely to re-evaluate its existing risk models to better account for the changing climate and the increased frequency and severity of catastrophic events. This could involve incorporating more sophisticated climate data and predictive analytics.

Looking Ahead: Adapting to a Changing Climate

The massive $2.387 billion in losses reported by Allstate serves as a wake-up call for the insurance industry. Adaptation and innovation are crucial to navigate the challenges posed by climate change. This includes:

-

Investing in Climate Resilience: Insurance companies need to invest heavily in strategies that promote climate resilience, such as improved building codes and infrastructure.

-

Developing Advanced Predictive Models: Utilizing advanced technologies and data analytics to improve risk assessment and prediction capabilities is essential.

-

Strengthening Public-Private Partnerships: Collaborative efforts between government agencies and the private sector are crucial to develop effective mitigation and adaptation strategies.

Allstate's significant year-to-date catastrophe losses highlight the urgent need for the insurance industry to adapt to the changing climate. The impact extends far beyond Allstate, affecting consumers, investors, and the broader financial landscape. The future of the insurance sector hinges on its ability to effectively manage and mitigate the risks posed by increasingly frequent and severe natural disasters. Only time will tell how the industry will respond to this challenge.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on $2.387 Billion In Cat Losses: Allstate's Year-to-Date Aggregate. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Tlc Big E Concert Cancellation Whos The Replacement

Sep 19, 2025

Tlc Big E Concert Cancellation Whos The Replacement

Sep 19, 2025 -

Rubbish Mailata Responds To Tush Push Accusations Following Eagles Win Espn

Sep 19, 2025

Rubbish Mailata Responds To Tush Push Accusations Following Eagles Win Espn

Sep 19, 2025 -

Sample Grant Proposal Bridging The Digital Divide For Refugee Learners

Sep 19, 2025

Sample Grant Proposal Bridging The Digital Divide For Refugee Learners

Sep 19, 2025 -

Lionel Messis Inter Miami Future Details Of Potential Multi Year Contract Emerge

Sep 19, 2025

Lionel Messis Inter Miami Future Details Of Potential Multi Year Contract Emerge

Sep 19, 2025 -

Katerina Siniakova Vs Sohyun Park Wta Korea Open 2025 Match Preview And Betting Tips

Sep 19, 2025

Katerina Siniakova Vs Sohyun Park Wta Korea Open 2025 Match Preview And Betting Tips

Sep 19, 2025

Latest Posts

-

Kordas 20 Aces Power Hangzhou 2025 Quarterfinal Run

Sep 19, 2025

Kordas 20 Aces Power Hangzhou 2025 Quarterfinal Run

Sep 19, 2025 -

Europe Signals Un Sanctions As Iranian Hardliners Consolidate Power

Sep 19, 2025

Europe Signals Un Sanctions As Iranian Hardliners Consolidate Power

Sep 19, 2025 -

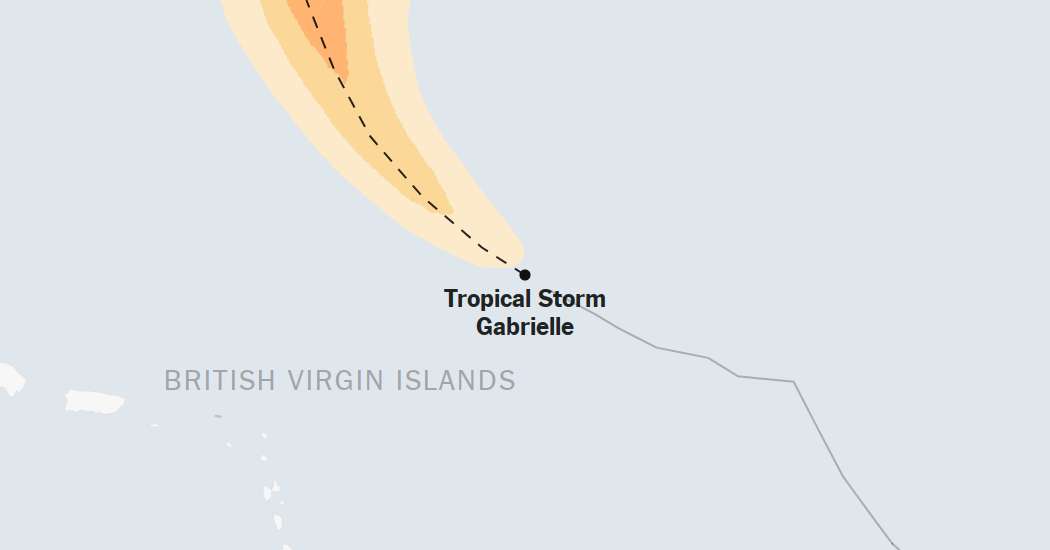

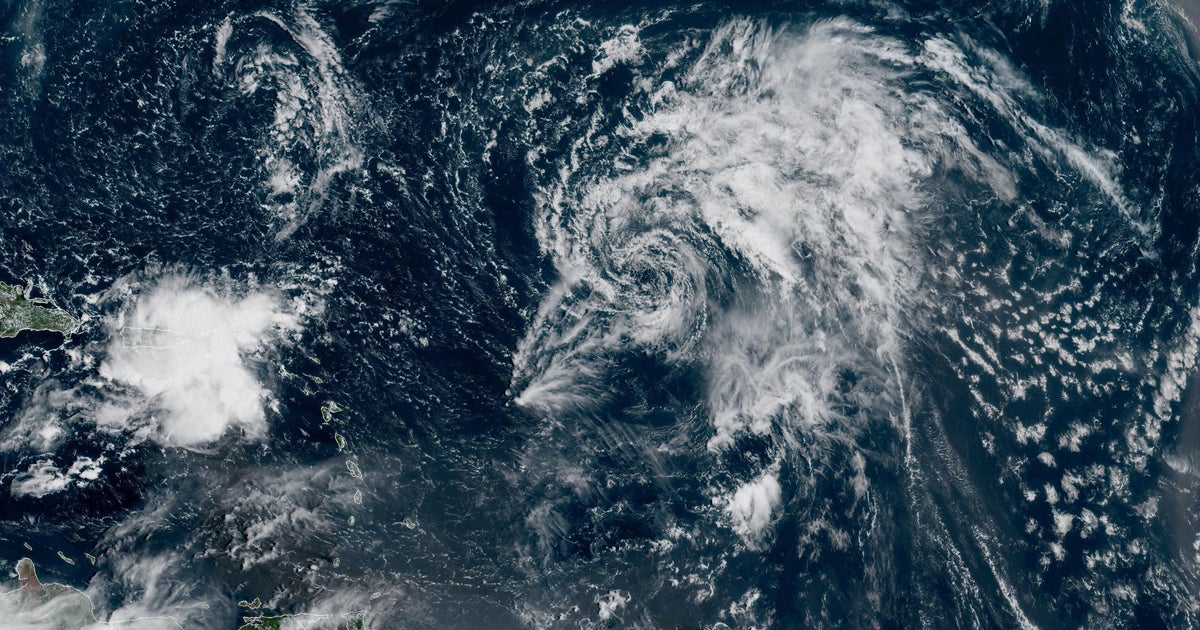

Tropical Storm Gabrielle Path Interactive Maps And Forecasts

Sep 19, 2025

Tropical Storm Gabrielle Path Interactive Maps And Forecasts

Sep 19, 2025 -

Moon Phase Today September 17th Lunar Illumination

Sep 19, 2025

Moon Phase Today September 17th Lunar Illumination

Sep 19, 2025 -

Real Time Maps Monitoring Tropical Storm Gabrielles Movement In The Atlantic

Sep 19, 2025

Real Time Maps Monitoring Tropical Storm Gabrielles Movement In The Atlantic

Sep 19, 2025