$2.387 Billion In Cat Losses: Allstate's Updated Pre-Tax Aggregate

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

$2.387 Billion in Cat Losses: Allstate's Updated Pre-Tax Aggregate Shakes Investor Confidence

Allstate Corporation, a leading name in the insurance industry, recently announced a staggering pre-tax catastrophe loss aggregate of $2.387 billion. This substantial figure, significantly higher than initial estimates, sent ripples through the financial markets and left investors questioning the company's future performance and the broader implications for the insurance sector. The updated figure reflects the devastating impact of recent severe weather events across the United States.

The announcement follows a period of intense weather activity, including hurricanes, wildfires, and severe thunderstorms, all of which contributed significantly to the increased loss. This underscores the growing vulnerability of the insurance industry to the increasingly frequent and intense effects of climate change.

Understanding the Impact of Catastrophic Losses:

Catastrophic losses, or "cat losses," represent insured losses resulting from large-scale events such as hurricanes, earthquakes, and wildfires. These events can cause widespread damage and result in billions of dollars in payouts for insurance companies. Allstate’s updated figure highlights the significant financial strain these events place on even the largest insurers.

The $2.387 billion pre-tax aggregate represents a substantial blow to Allstate's bottom line. While the company has a history of weathering such storms (pun intended!), the scale of this loss is noteworthy and warrants careful consideration of the company’s future strategies and financial stability. This significant increase from prior estimates raises concerns about the accuracy of initial loss assessments and the potential for further revisions.

What does this mean for Allstate and the insurance industry?

- Increased Premiums: This significant loss is likely to lead to increased insurance premiums for consumers. As insurers grapple with higher payouts, they will need to adjust their pricing models to maintain profitability. This could place a greater financial burden on homeowners and businesses, particularly those in high-risk areas.

- Re-evaluation of Risk Assessment: The magnitude of Allstate's losses will undoubtedly prompt a re-evaluation of risk assessment models within the insurance industry. More sophisticated and accurate predictive models are crucial to better anticipate and mitigate future catastrophic losses. This could involve incorporating more granular climate data and adopting advanced technological solutions.

- Investor Sentiment: The announcement has understandably impacted investor sentiment, leading to fluctuations in Allstate's stock price. Investors are now closely scrutinizing the company's ability to manage its exposure to future cat losses and maintain financial stability. This highlights the systemic risk associated with extreme weather events for investors in the insurance sector.

- The Role of Climate Change: The growing frequency and intensity of extreme weather events directly linked to climate change cannot be ignored. The insurance industry is on the front lines of this crisis, facing increasing challenges in managing the financial risks associated with a changing climate. This necessitates a proactive approach to climate risk management and adaptation strategies.

Looking Ahead:

Allstate's updated catastrophe loss figures serve as a stark reminder of the significant financial risks associated with extreme weather events and the crucial need for robust risk management strategies within the insurance industry. The long-term implications for both Allstate and the broader insurance sector remain to be seen, but the challenges are undeniably substantial. Further analysis will be needed to fully understand the full ramifications of this substantial loss. The industry's response will be crucial in ensuring its long-term viability and the protection of its policyholders. Further updates from Allstate and industry analysts will be closely followed.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on $2.387 Billion In Cat Losses: Allstate's Updated Pre-Tax Aggregate. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

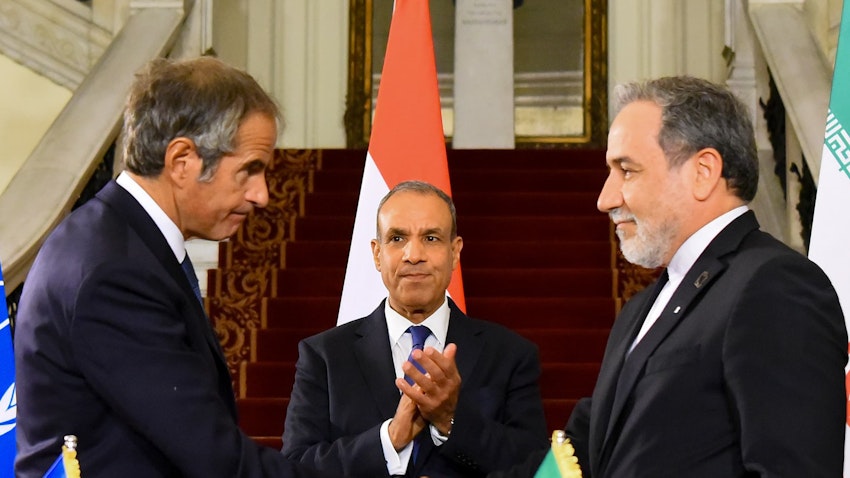

European Push For Un Sanctions Against Iran Sparks Hardliner Counter Rally

Sep 20, 2025

European Push For Un Sanctions Against Iran Sparks Hardliner Counter Rally

Sep 20, 2025 -

See The Moon Venus And Regulus A Step By Step Guide To The Planetary Conjunction

Sep 20, 2025

See The Moon Venus And Regulus A Step By Step Guide To The Planetary Conjunction

Sep 20, 2025 -

Watch Oklahoma State Vs Tulsa Ncaaf Game Tv Channel And Start Time

Sep 20, 2025

Watch Oklahoma State Vs Tulsa Ncaaf Game Tv Channel And Start Time

Sep 20, 2025 -

Frances Macron Renewed Iran Sanctions Likely

Sep 20, 2025

Frances Macron Renewed Iran Sanctions Likely

Sep 20, 2025 -

Sebastian Korda Vs Adam Walton Atp Hangzhou Day 3 Match Analysis

Sep 20, 2025

Sebastian Korda Vs Adam Walton Atp Hangzhou Day 3 Match Analysis

Sep 20, 2025

Latest Posts

-

Witness The Smiling Planets Triple Conjunction Visible This Week

Sep 20, 2025

Witness The Smiling Planets Triple Conjunction Visible This Week

Sep 20, 2025 -

Tonights Moon September 17th Moon Phase Guide

Sep 20, 2025

Tonights Moon September 17th Moon Phase Guide

Sep 20, 2025 -

Is Outfield Next For Ohtani Dodgers Perspective On His Role

Sep 20, 2025

Is Outfield Next For Ohtani Dodgers Perspective On His Role

Sep 20, 2025 -

Shohei Ohtani And The Dodgers Outfield Position A Real Possibility

Sep 20, 2025

Shohei Ohtani And The Dodgers Outfield Position A Real Possibility

Sep 20, 2025 -

Nfl Playoff Outlook The Underdogs With The Highest Probability Of Reaching The 2023 Postseason

Sep 20, 2025

Nfl Playoff Outlook The Underdogs With The Highest Probability Of Reaching The 2023 Postseason

Sep 20, 2025