$2.387 Billion In Cat Losses: Allstate's Pre-Tax Impact After August

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

$2.387 Billion in Cat Losses: Allstate's Pre-Tax Impact After August's Devastating Storms

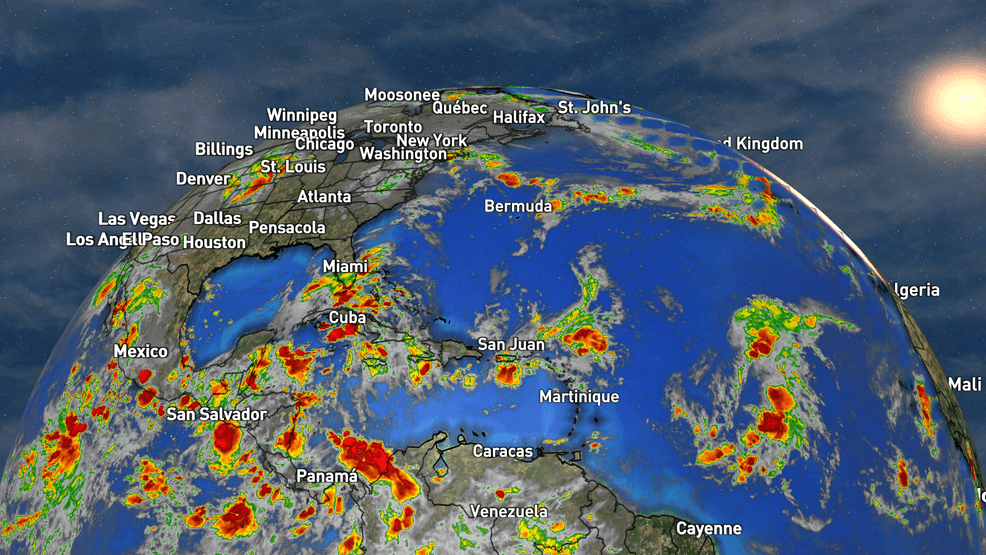

August 2023 proved to be a catastrophic month for insurers, and Allstate felt the impact significantly. The company announced a staggering pre-tax catastrophe loss of $2.387 billion, a figure that underscores the increasing severity and frequency of extreme weather events. This substantial loss highlights the growing challenges faced by the insurance industry in adapting to a changing climate. Understanding the details behind this massive figure is crucial for both investors and consumers.

The Impact of Hurricane Idalia and Other August Storms:

While Allstate hasn't broken down the exact contribution of each event, it's clear that Hurricane Idalia played a significant role in this massive pre-tax loss. The hurricane, which slammed into Florida's Gulf Coast, caused widespread devastation, leading to substantial property damage and numerous insurance claims. Other severe weather events across the country throughout August also contributed to the overall figure. This emphasizes the importance of comprehensive disaster preparedness and robust insurance coverage.

What This Means for Allstate Policyholders:

While the $2.387 billion pre-tax loss is significant for Allstate's bottom line, it doesn't directly translate into immediate premium increases for all policyholders. However, the increased frequency and severity of catastrophic events like hurricanes and wildfires will likely influence future pricing models. The insurance industry is analyzing these trends carefully and adjusting pricing strategies accordingly. It's crucial for policyholders to review their coverage regularly and ensure they have adequate protection for their assets.

The Broader Implications for the Insurance Industry:

Allstate's substantial losses are a stark warning for the entire insurance industry. The increasing costs associated with extreme weather events are unsustainable in the long run. This necessitates a multi-pronged approach, including:

- Improved risk assessment models: Insurers need to refine their models to accurately predict and assess the risk posed by climate change.

- Investment in mitigation strategies: This includes supporting initiatives aimed at reducing vulnerability to natural disasters.

- Innovation in insurance products: Developing new products that cater to the evolving needs of consumers in a high-risk environment.

- Collaboration with government and communities: Working together to build more resilient communities.

Looking Ahead: Climate Change and the Future of Insurance:

The $2.387 billion loss is not an isolated incident. It's a clear indicator of the escalating challenges posed by climate change. The insurance industry needs to adapt and innovate to remain financially viable while providing crucial protection to consumers. This requires a long-term strategy that involves not just adjusting premiums but also actively participating in climate mitigation and adaptation efforts. The future of insurance is inextricably linked to our ability to address climate change effectively.

Call to Action: Review your insurance coverage today. Ensure you have the adequate protection to safeguard your assets against the increasing risk of catastrophic events. Contact your insurance provider to discuss your options and explore any potential gaps in your coverage. Learn more about [link to a resource on disaster preparedness].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on $2.387 Billion In Cat Losses: Allstate's Pre-Tax Impact After August. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Spring Transfer Window Axed Ncaas New Transfer Policy Explained

Sep 20, 2025

Spring Transfer Window Axed Ncaas New Transfer Policy Explained

Sep 20, 2025 -

Espn Sources Messi Nearing Long Term Contract Extension With Inter Miami Cf

Sep 20, 2025

Espn Sources Messi Nearing Long Term Contract Extension With Inter Miami Cf

Sep 20, 2025 -

Increased Hurricane Activity In The Atlantic What To Expect

Sep 20, 2025

Increased Hurricane Activity In The Atlantic What To Expect

Sep 20, 2025 -

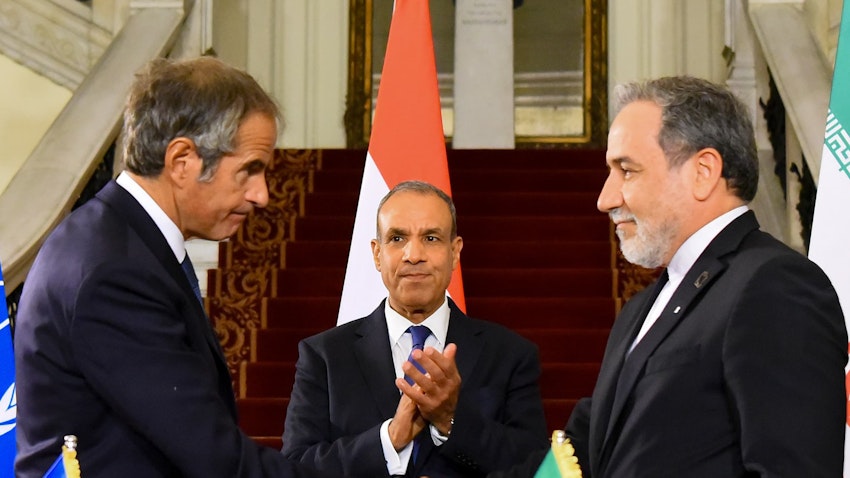

Iran Hardliners Consolidate Power Amidst Looming Un Sanctions

Sep 20, 2025

Iran Hardliners Consolidate Power Amidst Looming Un Sanctions

Sep 20, 2025 -

Ncaa Eliminates Spring Transfer Portal Window For Football Impact On College Football Recruiting

Sep 20, 2025

Ncaa Eliminates Spring Transfer Portal Window For Football Impact On College Football Recruiting

Sep 20, 2025

Latest Posts

-

Witness The Smiling Planets Triple Conjunction Visible This Week

Sep 20, 2025

Witness The Smiling Planets Triple Conjunction Visible This Week

Sep 20, 2025 -

Tonights Moon September 17th Moon Phase Guide

Sep 20, 2025

Tonights Moon September 17th Moon Phase Guide

Sep 20, 2025 -

Is Outfield Next For Ohtani Dodgers Perspective On His Role

Sep 20, 2025

Is Outfield Next For Ohtani Dodgers Perspective On His Role

Sep 20, 2025 -

Shohei Ohtani And The Dodgers Outfield Position A Real Possibility

Sep 20, 2025

Shohei Ohtani And The Dodgers Outfield Position A Real Possibility

Sep 20, 2025 -

Nfl Playoff Outlook The Underdogs With The Highest Probability Of Reaching The 2023 Postseason

Sep 20, 2025

Nfl Playoff Outlook The Underdogs With The Highest Probability Of Reaching The 2023 Postseason

Sep 20, 2025