1300% Tesla Stock Growth? Analyzing Elon Musk's Recent Statements And Market Impact

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

1300% Tesla Stock Growth? Analyzing Elon Musk's Recent Statements and Market Impact

The internet is abuzz with claims of a potential 1300% surge in Tesla stock. While such a dramatic increase hasn't actually occurred, the recent volatility and Elon Musk's pronouncements have fueled significant speculation, impacting the market in unpredictable ways. This article delves into the reality behind these claims, examining Musk's recent statements and their influence on Tesla's stock price and the broader market.

The Hype vs. the Reality:

The notion of a 1300% Tesla stock growth is misleading. While Tesla's stock has experienced impressive growth over the years, a sudden, massive jump of that magnitude hasn't happened. The rumors likely stem from a combination of factors: rapid, albeit fluctuating, growth in previous periods, optimistic predictions from analysts (some of whom have been wildly inaccurate), and the inherent volatility associated with Tesla's stock. Misinterpretations of short-term price spikes and exaggerated social media discussions further contribute to the confusion.

Elon Musk's Influence: A Double-Edged Sword:

Elon Musk's pronouncements on Twitter and other platforms have repeatedly shown the power of his words to move markets. His tweets, often cryptic or provocative, can trigger significant price swings in Tesla's stock. Recent examples include announcements regarding new product launches, production updates, or even seemingly unrelated comments that are quickly interpreted by investors and traders. This influence, however powerful, is a double-edged sword. While positive statements can boost the stock price, negative comments or controversial actions can lead to sharp declines. This unpredictability creates significant risk for investors.

Analyzing the Market Impact:

The speculation surrounding Tesla's stock price affects not only Tesla itself but the broader electric vehicle (EV) sector and the technology market as a whole. Tesla's success and Musk's pronouncements often serve as barometers for the entire industry. A significant jump (or drop) in Tesla's stock can influence investor sentiment toward other EV manufacturers, potentially leading to ripple effects across the market.

Key Factors Influencing Tesla's Stock Price:

Several factors beyond Musk's tweets contribute to Tesla's stock price fluctuations:

- Financial Performance: Quarterly earnings reports, revenue growth, and profit margins significantly impact investor confidence.

- Production and Delivery Numbers: Meeting or exceeding production targets and delivering vehicles to customers are crucial for maintaining positive investor sentiment.

- Technological Advancements: Announcing groundbreaking innovations, such as advancements in battery technology or autonomous driving capabilities, can boost investor optimism.

- Global Economic Conditions: Macroeconomic factors, like interest rates and inflation, can affect the overall market sentiment and investor appetite for risk.

- Competition: The growing competition in the EV market from established automakers and new entrants adds another layer of complexity.

Navigating the Volatility:

Investing in Tesla, or any high-growth stock, requires a high risk tolerance. The volatility inherent in Tesla's stock price should not be underestimated. Before investing, it's crucial to conduct thorough research, understand the risks involved, and consider diversifying your portfolio. Relying solely on social media or unsubstantiated claims for investment decisions can lead to significant financial losses.

Conclusion:

While the idea of a 1300% increase in Tesla stock is highly unlikely in the short term, the company's stock remains volatile and significantly impacted by Elon Musk's statements and various market forces. Investors need to approach Tesla stock with caution, conducting independent research and carefully considering the risks involved before making any investment decisions. Remember to consult with a qualified financial advisor before making any investment choices.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on 1300% Tesla Stock Growth? Analyzing Elon Musk's Recent Statements And Market Impact. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Expat Dreams Why Americans Are Choosing Portugal As Their New Home

May 28, 2025

Expat Dreams Why Americans Are Choosing Portugal As Their New Home

May 28, 2025 -

Over 100 000 Respond Americas 1 Choice For International Relocation

May 28, 2025

Over 100 000 Respond Americas 1 Choice For International Relocation

May 28, 2025 -

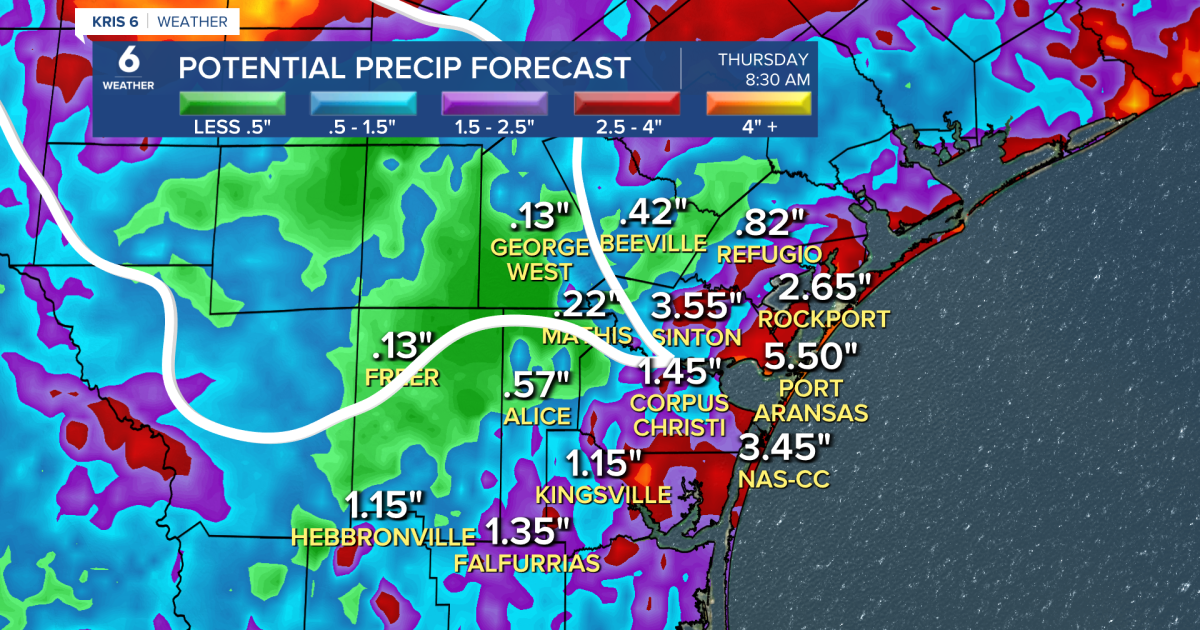

Expect Heavy Rain Series Of Weather Disturbances And Abundant Gulf Moisture

May 28, 2025

Expect Heavy Rain Series Of Weather Disturbances And Abundant Gulf Moisture

May 28, 2025 -

New Survey Reveals Portugal Is The Most Popular European Destination For Americans

May 28, 2025

New Survey Reveals Portugal Is The Most Popular European Destination For Americans

May 28, 2025 -

Fringe Nfl Teams A Deep Dive Into 2023 Playoff Probabilities

May 28, 2025

Fringe Nfl Teams A Deep Dive Into 2023 Playoff Probabilities

May 28, 2025